Vektor adds FILTER function!

🎉 We're very excited to announce a very important new function in Vektor: FILTER. Use the Filter function to filter any list in Vektor using an expression!

FILTER unlocks a variety of use cases like a) discovering the best market opportunities, b) identifing wasted opportunities, c) preventing high-risk situations, and d) analyzing underperformances of your positions.

e.g.

- 💎 What are the high APY lending markets?

- 💎 Which LP pools am I eligible for?

- 💎 Are any of my borrowed assets dropping in price?

- 💎 Do my current lend positions leave money on the table?

Check out these written examples below, or watch the demo:

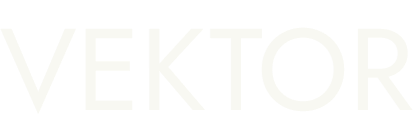

🛠️ Example: What are the high APY lending markets?

This is an exampls of using FILTER to discover the best market opportunities. We want to show all the lending markets with APY higher than 10%. So we filter on LEND.MARKETS with the condition being SUPPLY_APY > 10%.

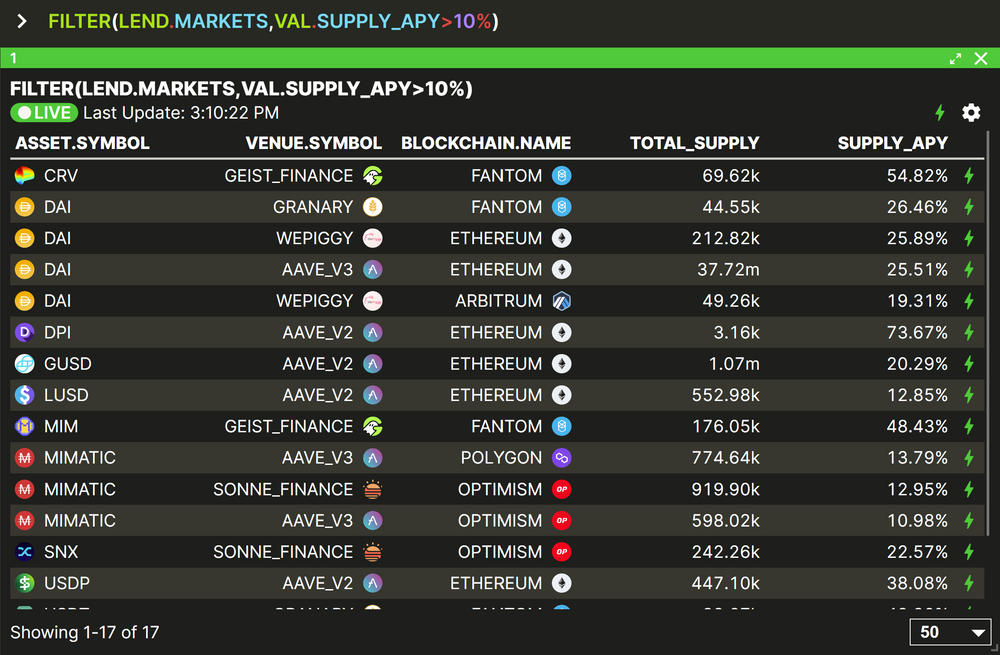

🛠️ Example: Which LP pools am I eligible for?

This is an exampls of using FILTER to identify wasted opportunities. We want to show all the liquidity pools that I can already deposit into with existing assets in my portfolio. So we take the LP.POOLS function and filter it to see where the pool assets intersect with the assets in my spot BALANCES.

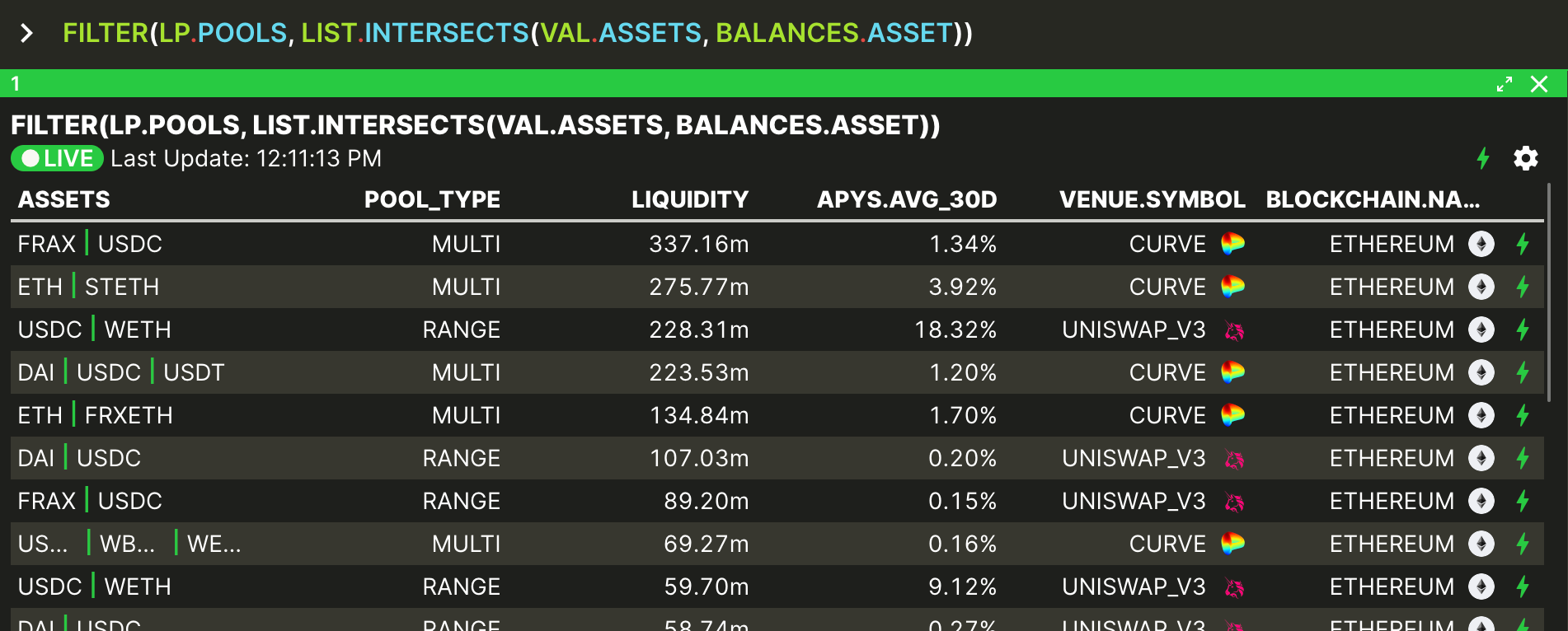

🛠️ Example: Are any of my borrowed assets dropping in price?

This is an exampls of using FILTER to prevent high-risk situations. We want to get my borrow positions where the price of the borrowed assets is down more than 10% in 30 days. So we take our BORROW.POSITIONS list and filter it to match assets that remain in a filtered version of the PRICES table. So it's a filter inside a filter.

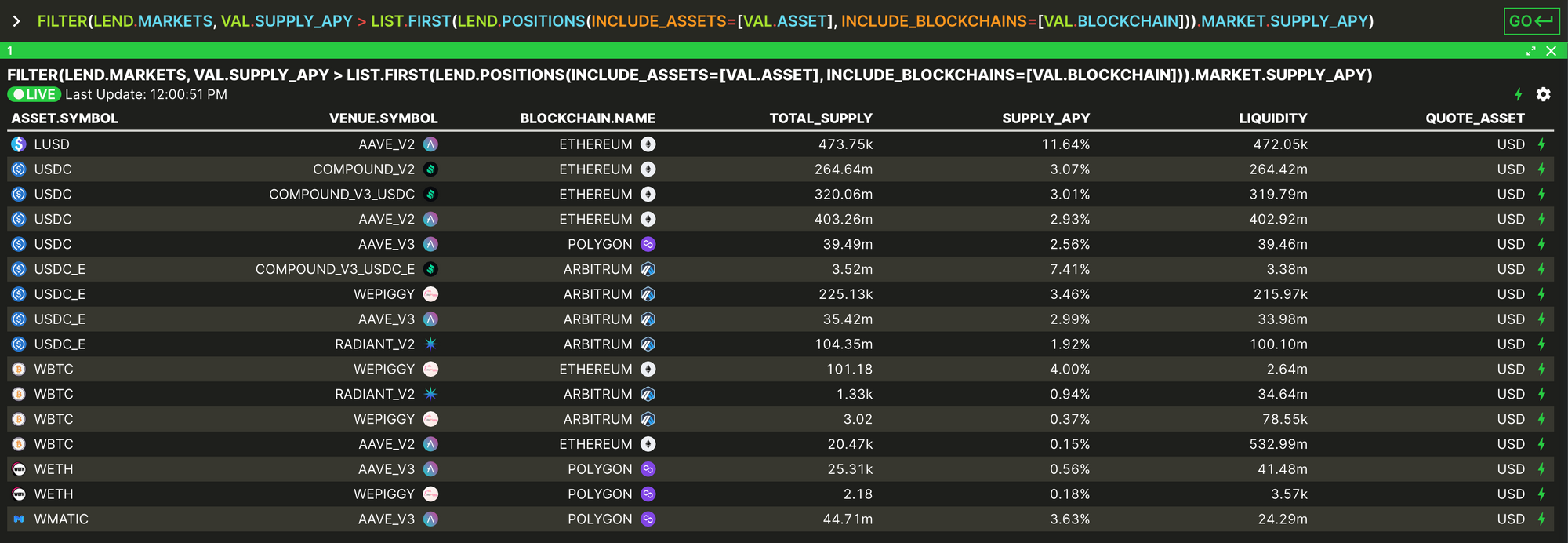

🛠️ Example: Do my current lend positions leave money on the table?

This is an example of using FILTER to analyze underperformances of your positions. We want to show all the lending markets that beat my current lend positions APYs (without having to bridge to another chain). It's an advanced command but very powerful!

Basically, if there's anything on this list, it means you're sufferering from opportunity cost.

These are just a few of the many things you can do with the FILTER function. Have a use case you'd like to share? We'd love to hear from you!

Read more:

- Filter function detailed docs

- LP functions announcement or detailed docs

- Lend & Borrow announcement or detailed docs

More updates coming soon... or check out our Product Update History for updates you may have missed. 😎