Why we're building Vektor

Using DeFi (Decentralized Finance) is hard. It’s hard to find out about all the investment opportunities going live every day on dozens of different blockchains, and even if you can find them, actually transacting with them involves a huge mess of open tabs, workflows, and fragmentation. And once you’ve entered positions, managing them manually and keeping on top of everything can be a huge time suck, effectively limiting the number of opportunities that can be monitored. Automation can help, but this involves either building complex bespoke systems internally, or high-friction capital migrations to third-party smart contracts that provide very rigid and limited solutions. All of this leads to higher costs, missed opportunities, and unnecessary losses.

It’s something that makes the lives of investors and fund managers rough, particularly because if they don’t solve this problem, they end up delivering inferior returns on their assets. If they drop a ball, forgetting to check one of their positions at the right time, it can mean tens or hundreds of thousands of dollars of lost gains or unnecessary losses. Moreover, from an efficiency standpoint, if they are spending too much time transacting with numerous clunky web interfaces, they’re missing out on potential opportunities in a fast-changing DeFi environment. For fund managers this will ultimately make it harder to differentiate their performance against their peers, and potentially harder to raise more LP funds or grow their businesses.

Given what is at stake here, it’s amazing how suboptimal the current solutions are. To take care of their investments, institutions resort to hiring multiple professionals around the world just so there is always someone awake to keep watch and execute transactions, which can be expensive and erode margins. Some will build complex internal systems at great cost to automate critical workflows, but then inevitably can’t keep up with the explosive growth of new opportunities in DeFi. Others will migrate their funds to third-party smart contracts that automate some execution functionalities, but these are walled gardens that introduce new risks, restrict other uses of those funds, and reduce capital efficiency.

Faced with these challenges of execution, many simply limit their number of active positions so they remain manageable. But meanwhile the optionality in DeFi is exploding; with more new ecosystems, chains, venues, and financial innovations launching on a regular basis. In other words, investors are being held back by limited execution tooling at precisely the worst time; while opportunities are snowballing. This demands a complete rethink of how we execute, automate, and keep track of DeFi positions.

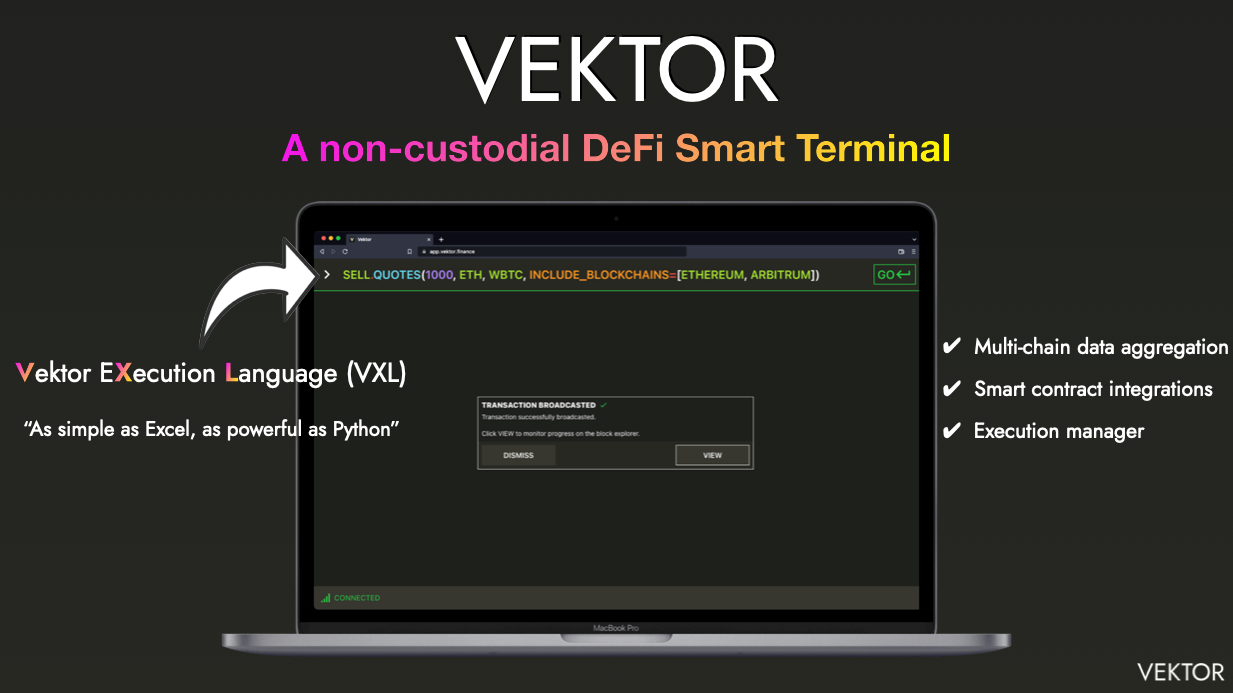

VEKTOR provides a next-generation interface for investors to compose and execute powerful transactions on multiple blockchains, while avoiding the complexities of DeFi. It looks a bit like a Bloomberg Terminal, except you can actually ‘make things happen’ by executing blockchain transactions directly from a command line. Commands are composed using a ‘spreadsheet-like’ syntax we’ve developed called VXL (Vektor eXecution Language) that’s designed to be especially familiar to investment professionals. VXL completely rethinks transaction execution, offering a universal language to access all of DeFi that’s as simple as Excel, but as powerful as Python. And because Vektor takes care of all the data aggregation, smart contract handling, and execution overhead, users are left to focus on their strategies, without needing to hire smart contract engineers to execute them.

Vektor’s architecture, designed around this universal execution language (VXL), gives it a number of distinct advantages over the status quo. For starters, it dramatically improves the experience of executing DeFi transactions, by compressing a substantial collection of transaction types, venues, and blockchains into one clean keyboard interface and focusing that power at your fingertips. For instance, researching and depositing an asset into the lender offering the best rate takes just seconds on Vektor, at least 10x faster (and probably much more) than using existing App UIs.

Moreover, VXL’s innate ability to aggregate cross-chain data points and incorporate them into bespoke nested formulas unlocks new ways to build custom, live-updating indicators in seconds. Being able to rapidly prototype indicators on Vektor instead of building bespoke internal systems saves tens or hundreds of thousands of dollars in engineering cost.

Best of all, Vektor can then use these custom indicators as automation triggers, intervening when conditions are met, to either send an alert or even execute transactions automatically. Thanks to VXL the automation possibilities are limitless, and thanks to Vektor’s non-custodial technology the transaction executions can be automated using your existing accounts; no need to lock up assets in single-recipe, on-chain automation contracts at the expense of capital efficiency. With Vektor automation, downside events or upside opportunities can be turned into immediate action, reducing unnecessary losses or locking in gains with a direct, often very meaningful, impact on investors ROI.